RPA Robotic Process Automation and the Growth of the Banking Industry

The worldwide trend of market capitalization of the banking sector has started to balance after the decline from 2008, due to the economic crisis. However, up to 2010, it hadn’t gotten anywhere close to its 2007 peak of 8.7 trillion U.S. dollars, according to Statista. So the bank industry at global scale is not in a position to say no to assurances of enhanced growth.

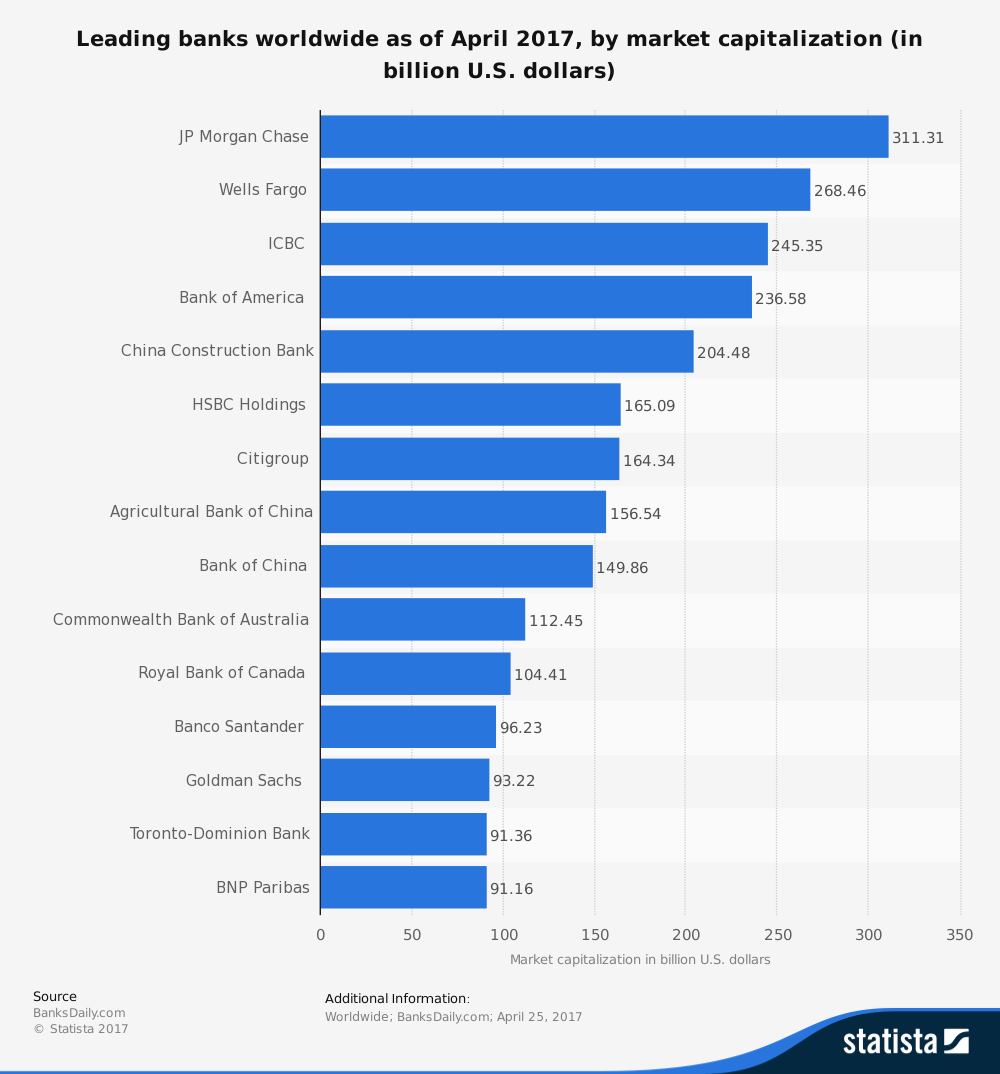

If we look at the leading banks worldwide as of April 2017 by market capitalization according to Statista, the US, China, Canada and Australia take the lead. However, the entire industry is marked by motivation to implement changes that are likely to resuscitate the banking system.

According to the 2018 Banking Industry Outlook, modernization was among the most important IT trends for almost 25% of global banking respondents to the 2016 Ovum ICT Enterprise Insights survey. And, of course, automation and its consequent changes in bank workforce is a crucial aspect of modernization.

In fact, as stated in the above-mentioned survey, banks should consider rethinking their workforce strategy given how work is evolving - with increasing automation and greater diversity in the labor pool [added emphasis]. Robotic process automation seems to be at the intersection of two themes deemed crucial by the survey for the growth of the banking sector - technology management and reimagining the workforce.

It is worth to also take into account a fact mentioned by Yakidoo, that 34% of organizations in the bank industry still rely on manual processes. So the use of RPA in banking might be a technological resource that is necessary to fuel the industry, to bring it back to the pre-crisis ascending trend, and to warrant its long-term sustainable growth.

Where to use RPA in banking?

In the banking industry there seems to be a plethora of domains where robotic process automation brings promises of growth: finance and accounting, sourcing and procurement, regulatory and compliance, financial risk management, and cyber risk and resilience.

On the dimension of finance and accounting, for instance, RPA tools may be used to calculate asset depreciation, to validate sales orders, or to maintain accounting master data. Robotic Process Automation also has the capacity to examine system logs to identify suspicious or illegal activity, thereby making a significant contribution to cyber risk management. The execution of timeliness, accuracy and comprehensiveness checks, or the performance of hasty remedy actions when required, are cases of RPA use to manage financial risks.

Benefits of RPA in banking

There are four main categories of benefits of RPA in banking. Each of them has other numerous favourable consequences, which further justify the extensive use of automation in the banking sector.

RPA leads to higher quality of work because it eliminates human error. That is no small task, given that human interaction accounts for an average of 4 errors per 100 tasks, according to Yakidoo. Errors affect customer satisfaction and hence, the bank’s reputation. It is only natural that people expect the ones who deal with their money to be ‘beyond error’ as much as possible.

The use of RPA products and solutions raises the standard of error-proof. Moreover, it allows the refocus of human bank staff on customer service, significantly improving customer care. By the elimination of error, RPA also warrants improved compliance.

Robots work faster and never get either tired or bored. This is extremely valuable because it leads to a significant productivity boost. Processes are monitored 24/7, leading to 100% accuracy on existing processes. According to Accenture, an indicator of the boost in productivity thanks to RPA is that the average handling time of ongoing processes is reduced with 40% compared to human staff handling. In fact, banks’ productivity gains may reach as much as 35-50%.

RPA software can be implemented fast, thereby allowing the bank’s system to remain open to new processes or updates of existing ones.

A generic benefit of robotic process automation is its cost saving potential. In an industry like banking, whose main interest is financial growth, this is probably the crucial advantage of RPA tools. They reduce processing costs by up to 80%, and guarantee payback in up to 3 months. Moreover, according to UiPath, RPA brings triple digit return of investments (ROIs) in the first year of operations.

We started from stating that sustainable growth of banking is the top priority for any technological update. To this end, RPA brings about substantial benefits like service excellence, lower costs, scalable operations, high compliance, and openness to innovation.

How to take advantage of RPA in banking

The first thing that must be done is to find the right RPA platform, where ‘right’ means ‘providing the easiest method for obtaining the above-mentioned benefits’. At CiGen, for instance, we use the UiPath technology to automate banking processes like end of day, mortgage, regulatory reporting, or audit, through application platforms like Banking Systems, LendFast, UltraData, Apply Online, Workflow Manager, or SharePoint.

Of course, it is always helpful to learn from examples. A very useful lesson comes from the implementation of robotic process automation at the Deutsche Bank, the national bank of Germany. Aside from a clear case of benefits (1) to (4) listed above, something important to learn from the Deutsche Bank experience is that RPA is not a quick fix, as stated by CIO.

Therefore, business owners’ expectations should be tailored accordingly. The primary reason why it is not a quick fix is that it requires an integrated approach to various parameters, such as system upgrades, underlying architectures or evolving business processes. For it to achieve the desired objectives, automation must not disregard any of the above and attempt to deal with them in conjunction.

Conclusion

To recap, robotic process automation in banking refers to the use of intelligent software to carry out dull, routine, repetitive tasks such as collecting and inputting data between portals, websites, internal applications and bank systems. The human staff is freed to handle the more rewarding work, thus leading to enhanced staff satisfaction. All in all, RPA leads to long term sustainable growth by eliminating the costs of human error, by being more cost savvy and by a general increase in productivity. And its implementation is convenient and relatively fast.

Given all the listed benefits and their desirable consequences, taken in a framework of realistically tailored prospects, the case for RPA in banking is compelling. By leveraging RPA to its full potential, the banking industry may enable a tremendous raise in its capacity and agility.

Oliver

Oliver

This is also a very good post which I really enjoyed reading. It is not Digital marketing in pune every day that I have the possibility to see something like this..

I feel very grateful that I read this. It is very helpful and very informative and I Python classes in pune really learned a lot from it.

Nice article Jan on how to prepare for RPA . I just want to add a few more points like taking mock tests pertaining to each knowledge area and full length mock tests also form key elements behind cracking the RPA course successfully. I've recently passed pmi exam. I took RPA course in Hyderabad.The training and mock exams helped me clearing the exam in first attempt without any hassles.