How Blockchain To FintechCan Increase Your Profit!

Since past couple of years, Blockchain is the buzzed terms for the industry.

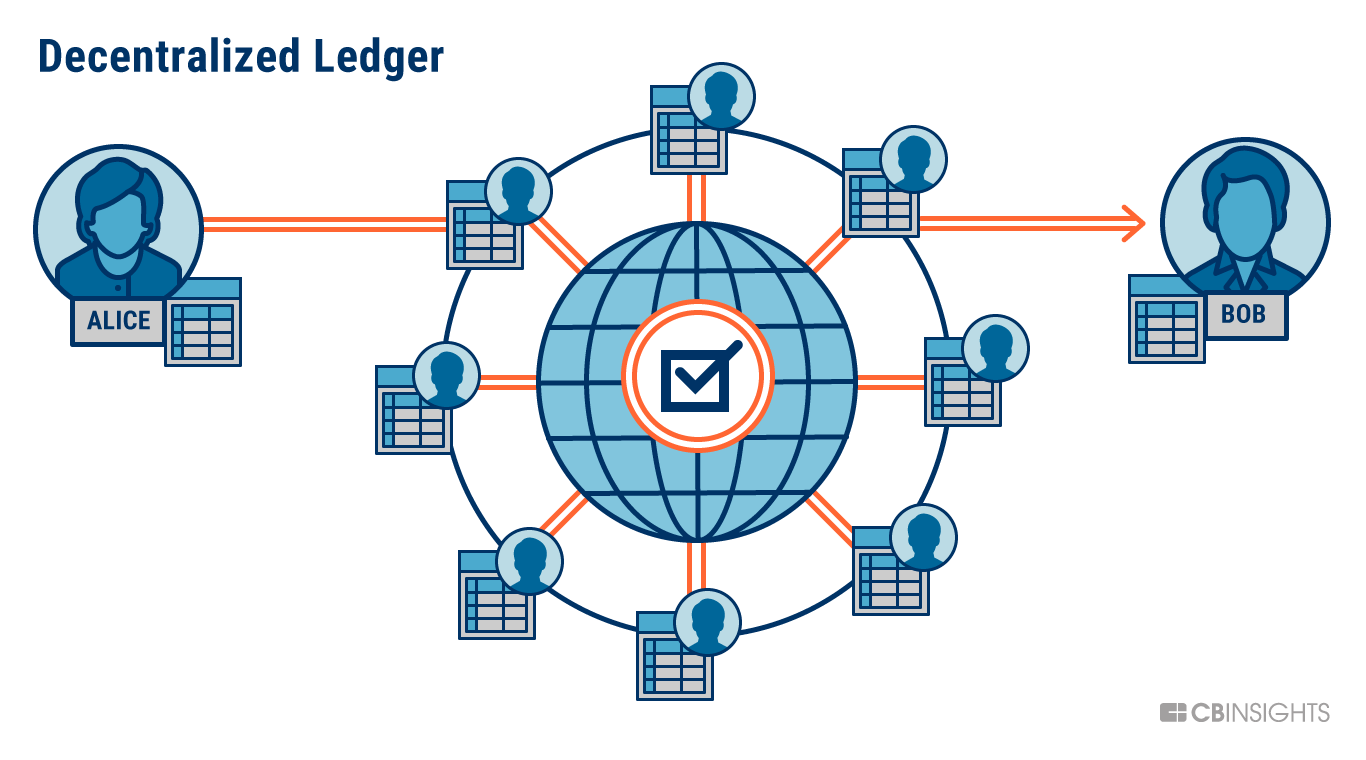

"A subsequently step that maintains a continuous growth of transactions from distributed traditional method towards modern database globally to integrate with all types of machines and source of data".

"The Blockchain is an incorruptible digital leader of economic transaction that can be programmed to record not a just financial transaction but virtually everything of value". We all have heard about Fintech and how it can change the world transactions that will increase security and user-friendliness over the globe. Entering an individual to formal financial sector allows them to built with lot many things with ease:

- online transactions over the globe

- credit history

- access credit

- pay for goods

- currency exchange

- online retailing, lending

World towards Digital possessions, payments & other money transaction has moved online including equity funding, currency exchange, and other payment apps made it possible for online transactions. Blockchain assures to produce a shift in the computing era of Blockchain Development Company due to its impending to become the infrastructure catalyst to create decentralized applications. One of the fastest growing industries of this decade, Fintech sector is been welcome with unfolding arms and growing at a high speed. According to 2017 Global Fintech Report, a startup needs funding in a huge amount that is growing day by day at CAGR of 41 percent to more than $40 billion in cumulative investment over the last four years. And 77 percent of respondents expect to adopt Blockchain by 2020.

Fintech Users can be,

- Technology- Bank as consumer

- Consumers who uses banking technology

- B2B- Clients, banks, partners, and more

- B2C- consumers and businesses to link with other systems

Blockchain can ensure the obligations of both parties met before the agreement with the help of Smart Contracts. It provides users and companies a decentralized network for information to be safe and secure that result with a fixed transfer of data. Smart Contract that is highly programmable that are developed uniquely by Ethereum that transfers the value transparently between parties and avoiding middleman that helps with a conflict-free transaction. Overall it reduces cost and increases the security for the banking sector are going to implement in a large way. Without technology, we or any industrial sector may not be able to reach such a secure transactions for user and companies.

Elaborating few applications of Blockchain to Fintech

Peer-to-peer: avoiding intermediaries by assembling buyers and sellers directly.

Crowdfunding: easy to raise fund from a large number of platforms over the globe.

Digital currency: it helps to exhibit properties similar to physical currencies for borderless transactions.

Payment gateway: secure payment system is used to set for safe transactions between financial institutes.

Data collection: the vast amount of data can be collected, tracked and analyzed.

The framework would enable just approved members to get to the information and keep a log of all the logging sections. Besides, the proposed framework will use Blockchain innovation to consolidate numerous current information stockpiling stages into one. This safe single system will expand the general proficiency and lessen the number of capacity areas of the client's information.

Challenges to address: Interoperability simply means a number of Blockchains that needs to operate various operations that needs great value in creating networks service providers so there is no single Blockchain that can operate with overall requirements. The Encryption used to store information can be imperiled by discovering escape clauses in the system which thusly, makes the Blockchain defenseless to programmer assaults. A private key created once must be kept safely as once it is lost or lost, there's no real way to get it back. Sustainability seems to diversify the technology used as there is no ensure for a particular protocol that can give you high volume solution. So it is hard to scale because of a high amount of energy.

The whole network needs to invest to Blockchain as it offers trust and safe transaction without any intermediary. Mobile app development company is all set to transform into payment, corporate banking, retail banking, and more. It can truly turn to a distributed leader that helps in securing process alike traditional one.

Enormous names like JP Morgan Chase have dedicatedly set their confidence later on of Blockchain innovation. The American worldwide speculation bank headquartered in New York City has begun another division called the Quorum division particularly for research and execution of Blockchain innovation. The majority is a dispersed record and keen contract stage for endeavors that backings expedient exchanges and throughput tending to difficulties for the fund business, banks, and past. As indicated by assets, they have as of now issued a yearly store declaration dependent on a circulating library with a variable rate.

As per Harvard Business Review, Blockchain into Fintech is surely a practical aspect that needs to get out of the lab into an actual business. Using an indelible Blockchain ledger to ensure with the security of data integrity and a proprietary compliance program based on structure analytic techniques. Application for the financial sector is designed to abide by every pertinent regulatory prerequisite and provide a sustainable transactional solution. The cost of extra bank account and to manage it for wealthy costumers is reduced along with reducing time to process with the same, Core banking came up with IT system software that allows a network of bank branches to be connected to settle all transactions to centralize at single core system.

Concluding Facts:

Fintech system with more innovative solutions process with allowing access to unbanked individuals for safe and secure transactions and it definitely going to shape the future with a change in business ecosystem & economy. Fintech is specially altering the features of businesses. Individuals can get to the universe of chance that the special few of us couldn't envision our lives without.

10 years back, it was incomprehensible that an organization in the UAE without stores could develop from nothing to being a feasible and gainful business sold for $650 million inside 12 years-this years, Souq.com has done quite recently that. What's more, this accomplishment has been acknowledged with 86% of the populace unfit to get to its administrations envision the chance on the off chance that we get this populace into the money related framework, and ready to buy merchandise and administration on the web.

Hansika

Hansika